How to Start a Lumpsum Investment Online on the Groww App

Want to start a lumpsum or one-time investment on the Groww app?

All you have to do is follow these simple steps:

Step 1: Type the Mutual Fund Name

Tap on the magnifying glass icon in the corner right of the screen and start typing the name of the mutual fund you want to invest in.

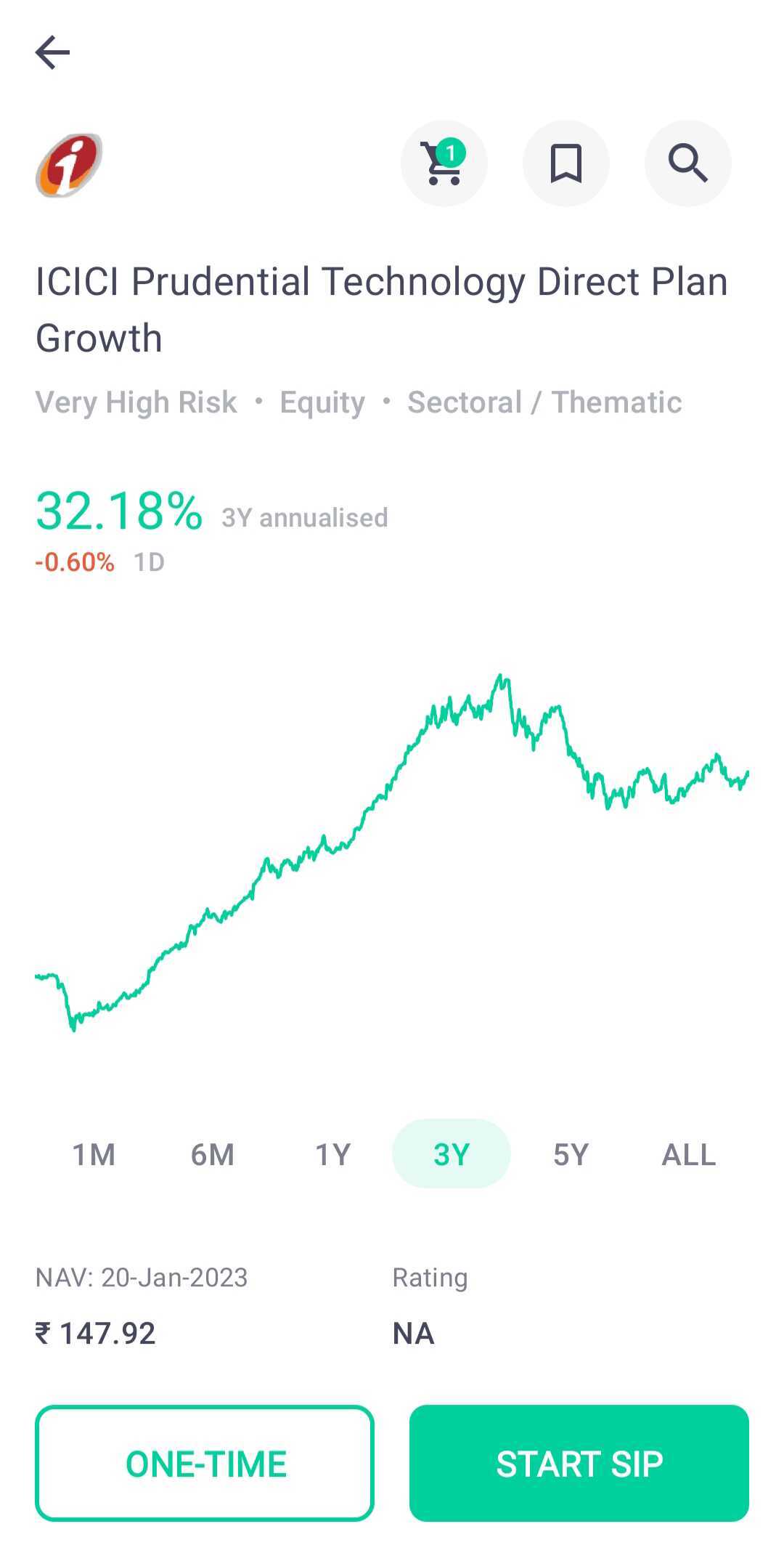

Step 2: Choose the Mutual Fund to Invest In

Once the name of your desired mutual fund shows up, tap on it. This will open the mutual fund’s page on the Groww app. Here you can see all the details of the fund.

Step 3: Tap ‘Invest Now’

Once you have seen the details of the mutual fund, click on ‘Invest Now’ to invest in the mutual fund. Next, you will be asked to choose the investment type. Here, click on ‘One-Time’.

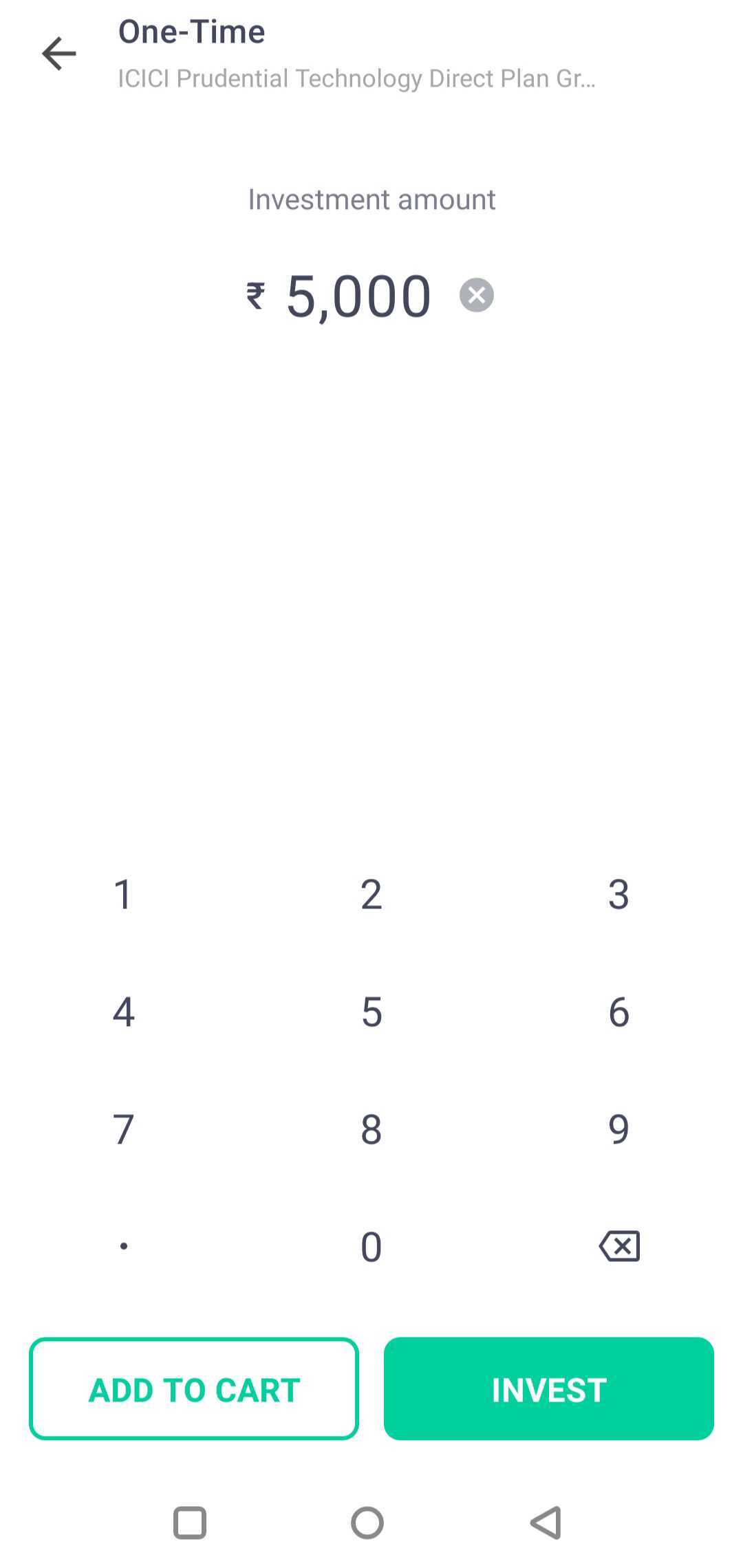

Step 4: Enter the Amount You Want to Invest

Enter the amount you want to start the investment for and click on ‘Proceed’.

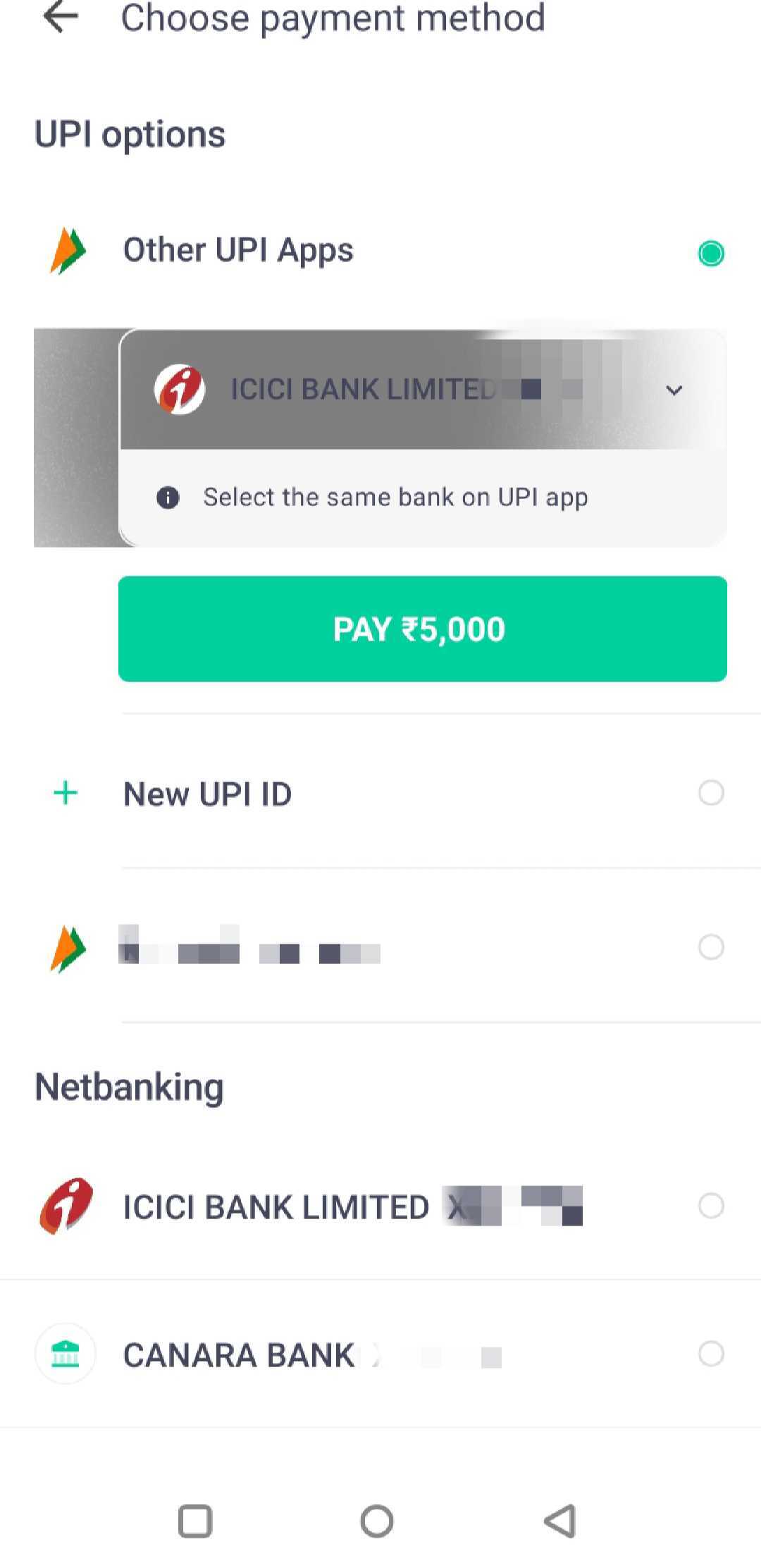

Step 5: Confirm and Make Payment

Tap on “Make Payment” and enter your payment details

Congratulations!

You have successfully invested! You will get a message confirming your investment.

Happy Investing!

|

You May Also Be Interested to Know- |

|

|

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

5. |

How to Invest in Direct Mutual Funds |